JDM INSURANCE SERVICES LTD

Terms of Business

JDM Insurance Services Ltd is regulated by the Central Bank of Ireland. These terms of business set out the basis on which JDM Insurance Services Ltd will provide business services to you as a client of the firm. They also contain details of our Regulatory and Statutory obligations and the respective duties of both the firm and you in relation to such services.

JDM Insurance Services Ltd is a member of Brokers Ireland.

Authorised Status

JDM Insurance Services Ltd is registered with the Central Bank of Ireland as an Insurance Intermediary under the European Union (Insurance Distribution) Regulations, 2018. A copy of our authorisation is available on request. Our Regulatory No. Is C64071. Our authorisation can be verified by contacting the Central Bank on 1890 77 77 77. We are subject to the Central Bank’s Consumer Protection Code, Minimum Competency Code, and Fitness & Probity Standards, which offer protection to consumers – these Codes can be found on the Central Bank’s website www.centralbank.ie.

Services Provided

JDM Insurance Services Ltd arranges and provides advice on a fair and personal analysis basis in relation to all classes of general insurance policies (motor, property, liability, marine etc.) and life assurance policies (term assurance, mortgage protection, serious illness cover, income protection, personal pensions, company pensions, PRSA’s, savings plans). Fair analysis means we conduct research across a wide range of product providers and products in the market.

We will identify and select a suitable product producer and on receipt of your instructions we will transmit orders on your behalf to one or more product producers (a list of which is available on request).

This firm does not have ‘tied’ relationship with any institution that would compromise our ability to offer you impartial advice and choice. We do not hold a holding, direct or indirect, representing 10 per cent or more of the voting rights or of the capital in any insurance undertaking and likewise no insurer has such a holding in JDM Insurance Services. We represent our customers when dealing with insurers. JDM Insurance Services Ltd offers advice and service on insurance claims.

JDM Insurance Services Ltd carries out insurance consultancy and project work for agreed fees.

In relation to insurance based investment products we provide advice on a non-independent basis, as we receive remuneration from insurers. We do not conduct a periodic assessment of the suitability of insurance based investment products on an ongoing basis unless instigated at your request. However, it is in your best interests that you review, on a regular basis, the products which we have arranged for you. As your circumstances change, your needs will change. You must advise us of those changes and request a review of the relevant policy/investment so that we can ensure that you are provided with up to date advice and products best suited to your needs. Failure to contact us in relation to changes in your circumstances or failure to request a review, may result in you having insufficient insurance cover and/or inappropriate investments.

We may provide information in paper format or via email e.g. Terms of Business, recommendations, product brochures, etc. Where you have provided us with your email address we operate on the basis that this represents your consent to receive documentation by email. On receipt of our emails, you may request paper copies.

Sustainable Finance Disclosure Regulation (‘SFDR’)

This EU Regulation is effective 10 March 2021. As the area of the SFDR is new and evolving without sufficient information being currently available, we do not currently assess in detail the adverse impact of investment decisions on suitability when providing investment or insurance advice. The key product providers with which we engage have developed responsible investment as part of their investment philosophies and sustainability policies. However, detailed information on specific fund recommendations we recommend is not always available. As further information on the approach being taken by product providers, and their internal/external fund managers, becomes available over the course of the next year, we anticipate reviewing these areas in our assessments.

Sustainability Remuneration Policies

We are remunerated by commission and other remuneration from product providers. The key product providers with which we engage, and receive remuneration from, have developed responsible investment as part of their investment philosophies and sustainability risk policies

Remuneration and Fees – General Insurance

JDM Insurance Services Ltd is remunerated by commission and other payments received from the product producers for the work involved in placing an order and finalising the product with them on your behalf. (Some product producers do not make any payment). A summary of the details of all arrangements for any fee, commission, other reward or remuneration paid or provided to JDM Insurance Services agreed with product producers is available on our website or we can send a copy on request.

A brokerage fee may also be charged or by agreement a combination of both. If a fee other than our standard fee is to be applied for the work activity and time spent in seeking the best terms, advice, product and product producer for your specific needs, we will confirm and agree this with you. Commissions receivable from product providers are not offset against any fees which we may charge you, unless otherwise agreed.

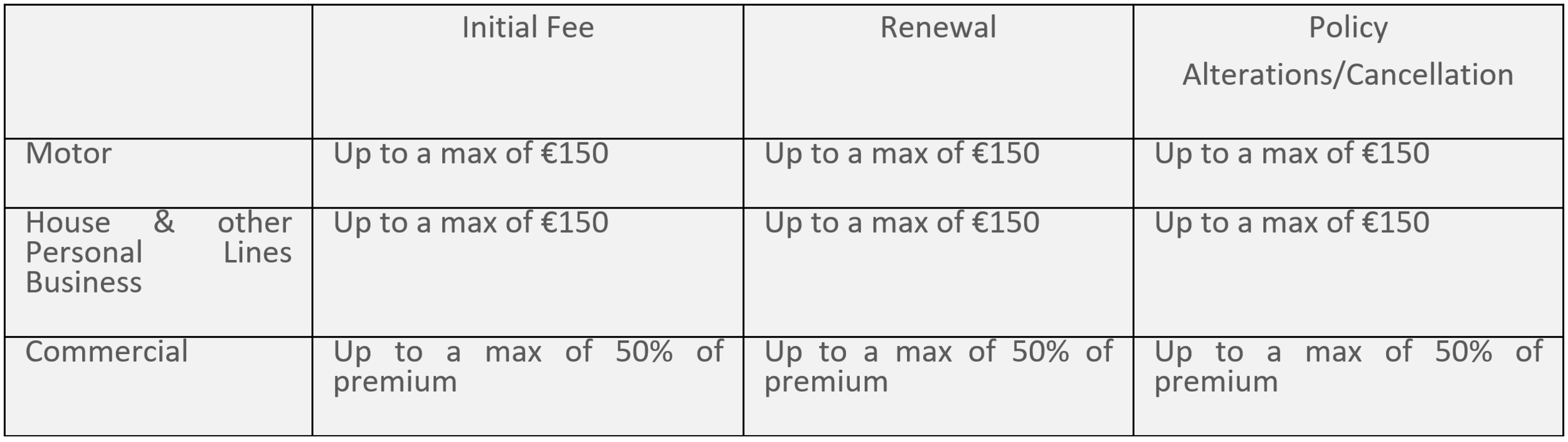

Standard administration fees will be applied to Commercial, Corporate and Personal Lines business in respect of New Business, Renewal and Mid-term alterations.

A scale of our fees as undernoted.

Remuneration and Fees – Life & Pensions

JDM Insurance Services Ltd is usually remunerated by commission and other payments received from insurers for the work involved in arranging a policy on your behalf in relation to life assurance, pensions and investments. We may receive override payments, renewal, or trail commissions from insurers for as long as your policies remain inforce. All amounts received contribute to our overall costs in providing you with a service on an ongoing basis.

An administration fee may also be charged or, by agreement, a combination of both. If a fee is to be applied or you wish to pay for our services by way of a fee, we will agree the basis of our fee with you in advance of providing a service. A summary of the details of all arrangements for any fee, commission, other reward or remuneration paid or provided to JDM Insurance Services agreed with product producers is available on our website or we can send a copy on request.

Investor Compensation Company Ltd (ICCL) Scheme

JDM Insurance Services Ltd is a member of the Investor Compensation Company Ltd (ICCL) Scheme established under the Investor Compensation Act, 1998. The legislation provided for the establishment of a compensation scheme and to the payment in certain circumstances, of compensation to certain clients of firms (known as eligible investors) covered by the Act. However, you should be aware that a right to compensation would only arise where client money or investment instruments held by this company on your behalf cannot be returned, either for the time being or for the foreseeable future, and where the client falls within the definition of eligible investor as contained in the Act. In the event that a right to compensation is established, the amount payable is the lesser of 90% of the client’s loss, which is recognised as being eligible for compensation, or €20,000.

Brokers Ireland Compensation Fund Ltd

As a member of Brokers Ireland, JDM Insurance Services Ltd is also a member of the Brokers Ireland Compensation Fund Ltd. Subject to the rules of the scheme the liabilities of its member firms up to a maximum of €100,000 per client (€250,000 in aggregate) may be discharged by the Fund on its behalf if the member firm is unable to do so, where the above detailed ICCL (established by law) has failed to adequately compensate any client of the member.

Data Protection

JDM Insurance Services Ltd is a Data Controller as defined in the Data Protection Acts 1998 – 2018 and the European Union’s General Data Protection Regulation effective from 25th May 2018 (collectively referred to as the GDPR). We operate to the highest standards of client confidentiality and meet statutory requirements under the GDPR.

We collect your personal details in order to provide the highest standards of service to you. We take great care with the information provided, taking steps to keep it secure and to ensure it is only used for legitimate and legal purposes. Our staff and support service providers will use your personal information to enable us to offer advice on suitable products, service your business on an ongoing basis, monitor services for quality control purposes, or as otherwise required by law. For these purposes we may share your contact details and other relevant information with product providers, our support service providers, for the purposes of providing you with appropriate advice and services, or with regulatory bodies if so requested.

We would also like to advise you of products and services we may offer from time to time from Melrose Finance Ltd, and any of our associated companies. In order to do so, we would like your consent so that we may contact you by letter, email, SMS text, or telephone (mobile and landline). You have the right to ask us not to send marketing information to you at any time.

Full details of our Data Privacy Notice – Customer Summary is available on request or on our website www.jdminsurance.ie.

Complaints Procedure

JDM Insurance Services Ltd has a written procedure in place for the effective consideration and handling of complaints. Any complaints should be addressed in writing to the Managing Director of JDM Insurance Services Ltd. Each complaint will be acknowledged by us within 5 working days of receipt, updates will be advised at intervals of not more than 20 working days. We will endeavour to resolve the complaint within 40 business days and findings will be furnished to you within 5 working days of completion of the investigation. In the event that you are not entirely satisfied with the firms handling of and response to your complaint, contact may be made with Brokers Ireland, 87 Merrion Sq., Dublin 2 and/or you have the right to complain to the Financial Services and Pensions Ombudsman, 3rd Floor, Lincoln House, Lincoln Place, Dublin 2.

Governing Law and Language

The laws of Ireland form the basis for establishing relations between you and JDM Insurance Services Ltd. All contracts, terms, conditions and communications relating to any policies you may enter with this firm will be in English.

Duty of disclosure

It is your responsibility to provide complete and accurate information for insurers when arranging an insurance policy, throughout the life of that policy, and when you are renewing it. It is important that you ensure that all information provided and all statements made on proposal forms, claim forms, and other documents are, to your knowledge and belief, complete and accurate. Failure to disclose any material information to your insurers could invalidate your insurance cover and could mean that all or part of a claim will not be paid.

Research / Market Security

JDM Insurance Services Ltd. use both local and international insurers / markets to obtain the best terms and conditions available. In selecting an Insurer, a wide variety of factors are taken into account including the financial statements of the insurer in question. We do not, and cannot, guarantee the financial security of any insurer. If you have any concerns about the security offered please contact us immediately.

For certain classes of insurance, for example, where we have a specialist product line or if you are a member of an organisation or professional body for which we have arranged a bespoke policy, we may select one or more preferred providers and arrange all such insurances with those providers.

Claims

It is essential that we are notified immediately of any claims or circumstances which could give rise to a claim. When you notify us, you must include all material facts concerning the claim. The policy wordings will describe in detail the procedures and conditions in connection with making a claim. It should be noted that there is no cover for defence costs incurred without Insurer’s prior consent.

Receipt

JDM Insurance Services Ltd. shall issue a receipt for each non-negotiable or negotiable instrument or payment received. These are issued with your protection in mind and should be held safely.

Consumer Insurance Act 2019

If you fall within the definition of ‘consumer’ as set out in the Consumer Insurance Act 2019, certain provisions of the Act impose new responsibilities on insurers and consumers, aimed at enhancing consumer protection. Set out below are some specific points arising from the new legislation effective from 1 September 2020.

New Business & Renewal

A consumer may cancel a contract of insurance, by giving notice in writing to the insurer, within working 14 days after the date the consumer was informed that the contract is concluded. In the case of general insurance, tThe insurer cannot impose any costs on the consumer other than the cost of the premium for the period of cover.

The consumer is under a duty to pay their premium within a reasonable time, or otherwise in accordance with the terms of the contract of insurance.

A court of competent jurisdiction can reduce the pay-out to the consumer where they are in breach of their duties under the Act, in proportion to the breach involved.

Post-Contract Stage and Claims

If, in respect of the insurance contract the insurer is not obliged to pay the full claim settlement amount until any repair, replacement or reinstatement work has been completed and specified documents for the work have been furnished to the insurer, the claim settlement deferment amount cannot exceed

o 5% of the claim settlement amount where the claim settlement amount is less than €40,000, or

o 10% of the claim settlement amount where the claim settlement amount is more than €40,000

An insurer may refuse a claim made by a consumer under a contract of insurance where there is a change in the risk insured, including as described in an “alteration of risk” clause, and the circumstances have so changed that it has effectively changed the risk to one which the insurer has not agreed to cover.

Any clause in a contract of insurance that refers to a “material change” will be interpreted as being a change that takes the risk outside what was in the reasonable contemplation of the contracting parties when the contract was concluded.

The consumer must cooperate with the insurer in an investigation of insured events including responding to reasonable requests for information in an honest and reasonably careful manner and must notify the insurer of the occurrence of an insured event in a reasonable time.

The consumer must notify the insurer of a claim within a reasonable time, or otherwise in accordance with the terms of the contract of insurance.

If the consumer becomes aware after a claim is made of information that would either support or prejudice the claim, they are under a duty to disclose it. (The insurer is under the same duty).

If the consumer makes a false or misleading claim in any material respect (and knows it to be false or misleading or consciously disregards whether it is) the insurer is entitled to refuse to pay and to terminate the contract.

Where an insurer becomes aware that a consumer has made a fraudulent claim, they must notify the consumer advising that they are avoiding the contract of insurance. It will be treated as being terminated from the date of the submission of the fraudulent claim. The insurer may refuse all liability in respect of any claim made after the date of the fraudulent act, and the insurer is under no obligation to return any of the premiums paid under the contract.

Effective Date

These Terms of Business are effective from 10th August 2023 until further notice.